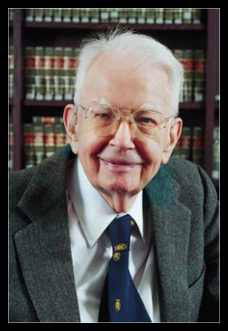

Ronald Coase, 1920-2013, R.I.P.

03 09, 13 13:35

Prof. Ronald Coase died Monday September 2 after a brief illness at age 102. He was the oldest living Nobel Prize winner. He was awarded the Nobel Prize in Economics in 1991. He was famous for 2 pioneering papers that The NY Times describes as follows:

- In one, “The Nature of the Firm,” which was largely developed while he was still an undergraduate and published in 1937, Professor Coase revolutionized economists’ understanding of why people create companies and what determines their size and scope. He introduced the concept of transaction costs — the costs each party incurs in the course of buying or selling things — and showed that companies made economic sense when they were able to reduce or eliminate those costs by performing some functions in-house rather than dealing in the marketplace.

- In the second of his groundbreaking papers, “The Problem of Social Cost,” published in 1960, Professor Coase challenged the idea that the only way to restrain people and companies from behaving in ways that harmed others was through government intervention. He argued that if there were no transaction costs, the affected parties could negotiate and settle conflicts privately to their mutual benefit, and that fostering such settlements might make more economic sense than pre-empting them with regulations. The paper made the idea of property rights fundamental to understanding the role of regulation in the economy. It grew out of a study by Professor Coase of how the Federal Communications Commission licensed broadcasters.

In memory of Prof. Coase, here is a brief quote from that paper:

V. PRIVATE PROPERTY AND THE ALLOCATION OF FREQUENCIES

If the right to use a frequency is to be sold, the nature of that right would have to be precisely defined. A simple answer would be to leave the situation essentially as it is now: the broadcaster would buy the right to use, for a certain period, an assigned frequency to transmit signals at a given power for certain hours from a transmitter located in a particular place. This would simply superimpose a payment on to the present system. It would certainly make it possible for the person or firm who is to use a frequency to be determined in the market. But the enforcement of such detailed regulations for the operation of stations as are now imposed by the Federal Communications Commission would severely limit the extent to which the way the frequency was used could be determined by the forces of the market.

It might be argued that this is by no means an unusual situation, since the rights acquired when one buys, say, a piece of land, are determined not by the forces of supply and demand but by the law of property in land. But this is by no means the whole truth. Whether a newly discovered cave belongs to the man who discovered it, the man on whose land the entrance to the cave is located, or the man who owns the surface under which the cave is situated is no doubt dependent on the law of property. But the law merely determines the person with whom it is necessary to make a contract to obtain the use of the cave. Whether the cave is used for storing bank records, as a natural gas reservoir,or for growing mushrooms depends,not on the law of property,but on whether the bank, the natural gas corporation,or the mushroom concern will pay the most in order to be able to use the cave. One of the purposes of the legal system is to establish that clear delimitation of rights on the basis of which the transfer and recombination of rights can take place through the market. In the case of radio, it should be possible for someone who is granted the use of a frequency to arrange to share it with someone else, with what- ever adjustments to hours of operation,power, location and kind of transmitter, etc., as may be mutually agreed upon; or when the right initially acquire is the shared use of a frequency (and in certain cases the FCC has permitted only shared usage), it should not be made impossible for one user to buy out the rights of the other users so as to obtain an exclusive usage.

Obits & Tributes:

Wall Street Journal

- Ronald Coase, Author of 'Most-Cited Law Review Article,' Dead at 102

- Economist's Theories Led to Carbon Trading

- Review & Outlook: The Wisdom of Ronald Coase

- The Man Who Resisted 'Blackboard Economics'

New York Times

- Ronald H. Coase, a Law Professor and Leading Economist, Dies at 102

- Economic View: Of Individual Liberty and Cap and Trade

Washington Post

- Oldest Nobel Prize winner Ronald Coase, influential British-born economist, dies at age 102

- Ronald H. Coase, U. of Chicago professor who won the Nobel Prize in economics, dies at 102

- 5 Ronald Coase papers you need to read

blog comments powered by Disqus

![Validate my RSS feed [Valid RSS]](valid-rss-rogers.png)